Experience a financial turnaround as Adani stocks rally, surging up to 11% after the Supreme Court dismisses petitions linked to the Adani-Hindenburg issue.

Adani Group’s flagship firm, Adani Enterprises, leads the charge with a 5% jump, while Adani Total Gas and Adani Energy Solutions impressively rise over 8% and 9%. The Supreme Court’s verdict, emphasizing no grounds to quash FPI regulations, sparks a positive market dynamic. Adani Ports and SEZ, along with Adani Enterprises, emerge as top gainers on the Nifty 50. The judiciary’s trust in SEBI’s ongoing probe further boosts confidence. This remarkable rebound follows the Hindenburg report’s aftermath, with Adani Group stocks recovering from an 80% decline. Explore the resurgence as the overall market capitalization surpasses Rs 15 lakh crore, signaling a triumphant comeback for the Adani Group.

Adani Stocks Rally: Supreme Court Verdict Sparks Phenomenal Surge

Unprecedented Rally Post Supreme Court Verdict

In a surprising turn of events, the Adani Group witnessed an extraordinary resurgence, with its stocks soaring by up to 11% following the Supreme Court’s dismissal of petitions related to the Adani-Hindenburg controversy. The apex court’s decision rejecting calls for a Special Investigation Team (SIT) or CBI probe sent shockwaves through the market, triggering a remarkable rally in Adani Group shares.

Adani Enterprises Leads the Charge

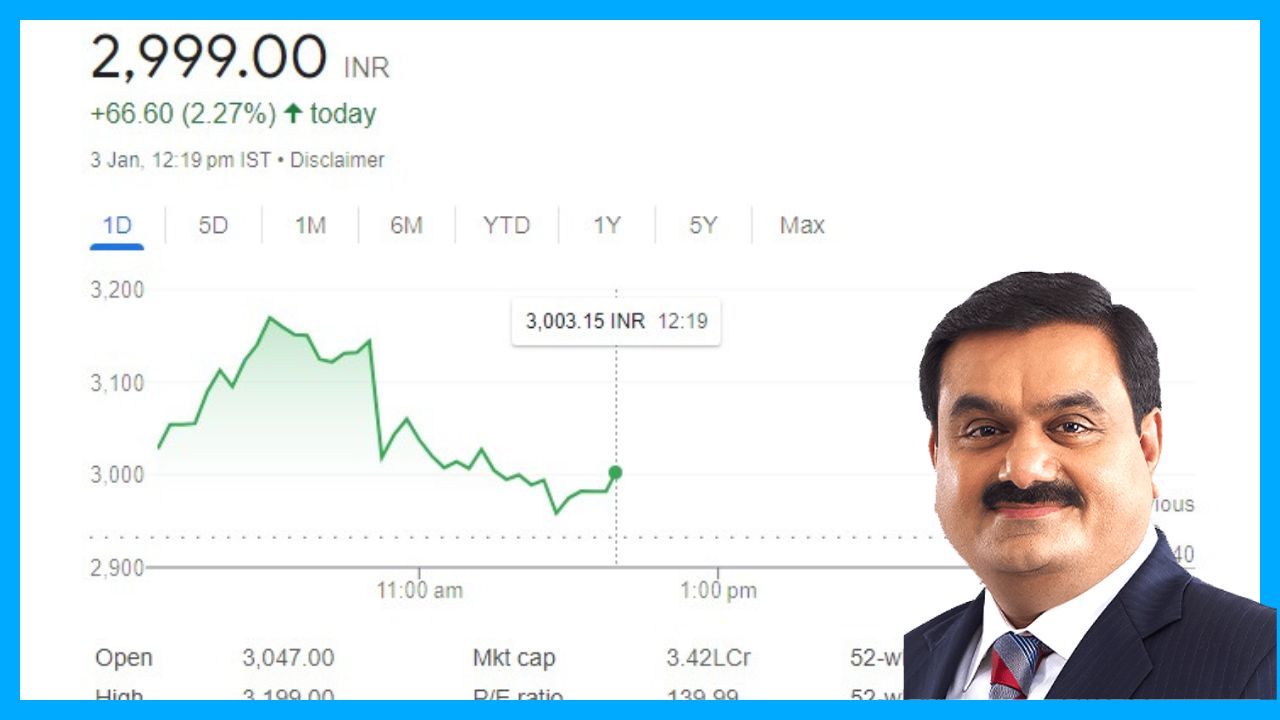

The flagship firm, Adani Enterprises, spearheaded the charge of Adani stocks rally with a nearly 5% surge in morning deals. Adani Total Gas and Adani Energy Solutions followed suit, boasting impressive gains of over 8% and 9%, respectively. Surprisingly resilient against the overall weak market sentiment, Adani Group companies collectively surged up to 11%, defying earlier concerns.

Supreme Court Verdict: No Grounds to Quash FPI Regulations

The Supreme Court’s verdict, delivered on January 3, 2024, emphasized that no substantial grounds were presented to quash the Foreign Portfolio Investor (FPI) regulations, which had initially led to sharp declines in Adani Group share prices. The court, in its wisdom, declared, “No valid ground raised to revoke amendment to FPI, LODR recommendations, SEBI directed to complete remaining 2 probes within 3 months.”

Adani Ports and SEZ, Adani Enterprises Top Nifty 50 Gainers

This judicial pronouncement swiftly translated into positive market dynamics, with shares of Adani Ports and SEZ, as well as Adani Enterprises, leading the Nifty 50 as top gainers, rising by 2% and 5%, respectively. Other Adani Group entities, such as Adani Wilmar, Adani Green Energy, Adani Power, Adani Total Gas, and Adani Energy Solutions, all witnessed substantial gains ranging from 3% to an impressive 11%.

Supreme Court’s Trust in SEBI’s Ongoing Probe

The Supreme Court’s decision comes after more than a month of deliberation, following the court’s reservation of judgment in November on various petitions pertaining to allegations of stock price manipulation by the Adani Group. Notably, other stocks connected to the Adani Group, including NDTV, ACC, and Ambuja Cements, also experienced positive momentum, trading with gains of up to 6%.

SEBI’s Mandate: Continue Investigation into Hindenburg Allegations

Back on March 2, 2023, the Supreme Court had instructed the market regulator, SEBI, to persist with its investigation into the allegations stemming from the Hindenburg report. SEBI’s mandate was clear: to scrutinize whether there was any manipulation of stock prices in violation of existing laws. A three-judge bench led by Chief Justice D.Y. Chandrachud reserved the verdict in November, and now, with the recent decision, the apex court has reaffirmed its trust in SEBI’s ongoing probe.

Hindenburg Report: Not Absolute Truth, Supreme Court Emphasizes

Crucially, the Supreme Court underscored that the Hindenburg Research report should not be treated as an absolute statement of truth. The court highlighted that doubting SEBI’s probe based solely on a few media reports would be unwarranted, emphasizing the need for a comprehensive and impartial examination of the case.

Adani Group’s Remarkable Rebound

The surge in Adani Group stocks marks a spectacular rebound from the depths they plunged to, with some stocks experiencing declines of as much as 80% in the aftermath of the Hindenburg report. Notably, Adani Ports has not only recovered all its Hindenburg losses but is now trading at new highs. Other group companies have also managed to significantly narrow their losses. Adani Stocks Rally is reawakened customer faith in the Adani stocks.

Market Capitalization Triumph: From Low to Rs 15 Lakh Crore

Although the overall market capitalization of the Adani Group has surpassed the Rs 15 lakh crore mark, it remains below the peak of Rs 23 lakh crore. Nevertheless, the market capitalization has more than tripled from the record low of Rs 5.8 lakh crore reached during the Hindenburg saga, signaling a remarkable turnaround for the conglomerate.

Adani Group’s Triumphant Financial Narrative

The Supreme Court’s decisive verdict has not only cleared the cloud of uncertainty surrounding the Adani Group but has also ignited a spectacular Adani Stocks Rally. The market’s resounding response underscores the resilience and confidence in the group’s fundamentals, marking a triumphant chapter in the Adani Group’s financial narrative.